How PayPal is Working to Boost Its Margins and Reignite Growth in 2024!

When I started using PayPal for my business, high fees were hurting my margins. But with their recent improvements in checkout and lower costs, I’m already seeing better profits. It’s clear PayPal is focused on reigniting growth for businesses like mine.

PayPal is working to boost its margins and reignite growth by cutting costs, improving branded checkout, and expanding Venmo for business use. These moves aim to enhance profitability and drive new growth, especially for small businesses.

Stay tuned as we explore how PayPal is working to boost its margins and reignite growth. We’ll break down the latest strategies and what they mean for you!

Leadership Changes – A New Approach for PayPal!

The Shift in Leadership:

In 2023, PayPal made a big change by appointing Alex Chriss as CEO. Chriss, who previously worked at Intuit, brought a fresh perspective to the company. He quickly realized that PayPal had spread itself too thin with too many acquisitions and a lack of focus on profitability.

Chriss set out to streamline operations and shift the company’s focus back to its core strengths. A major part of his plan has been reshaping PayPal’s management team, bringing in experienced leaders from companies like Walmart and Verizon. This leadership overhaul has helped PayPal become more focused on growth while keeping costs in check.

Cutting Costs for Better Margins:

One of Chriss’s main priorities was to focus on cost discipline. PayPal had to reduce unnecessary spending, cut back on underperforming areas, and work on making the company leaner.

These steps have helped improve the company’s profit margins, making each transaction more valuable. By focusing on what truly matters, PayPal has been able to run more efficiently while still pushing for growth.

READ MORE: cool:urriytflh98= car – A Blend of Power, Style, and Technology!”

Boosting Transaction Margins – A Key to Profitability!

What Are Transaction Margins?

Transaction margins refer to the amount PayPal makes from each payment after subtracting its costs. This number is critical for PayPal’s profitability.

In recent years, its margins had been under pressure due to competition from services like Apple Pay, Google Pay, and Zelle. However, PayPal has taken important steps to improve this key metric.

Improved Merchant Solutions:

One of the most important areas PayPal is focusing on to improve transaction margins is merchant services. The company is making it easier for businesses to use PayPal’s payment solutions and giving them more features to boost sales.

For example, PayPal has improved its branded checkout solution, which helps merchants convert more visitors into paying customers by reducing cart abandonment.

By offering businesses a better, more efficient way to process payments, PayPal can increase the volume of transactions and, in turn, boost its margins.

Venmo: Turning a Consumer App into a Business Tool:

PayPal has also been focusing on Venmo, its popular peer-to-peer payment service. Venmo has traditionally been used by individuals to send money to friends, but PayPal is now pushing to make it more useful for businesses.

This shift opens up a new revenue stream for PayPal. Venmo is now accepted by several large companies like DoorDash and Starbucks, driving more transactions and helping to boost PayPal’s overall margins.

PayPal’s Plans for Growth in 2024 – What You Need to Know!

Focus on Branded Checkout:

One of PayPal’s main strategies for reigniting growth is to double down on its branded checkout services. This is the payment system that businesses use to accept payments from customers. In 2024, PayPal is making branded checkout faster, more secure, and easier to use.

The company is improving the user experience to make payments smoother for both consumers and businesses. These updates are designed to attract more merchants and make PayPal a more compelling choice in the digital payment space.

With competition from Apple Pay and Google Pay, PayPal needs to offer something unique and convenient to stay competitive. By enhancing its branded checkout and offering more features, PayPal hopes to increase its market share in the payment space.

Expanding Into Offline Payments:

Another key area of growth for PayPal is offline payments. This involves integrating PayPal into point-of-sale (POS) systems in physical stores.

By offering a solution for in-person transactions, PayPal can expand its reach beyond just online payments. In 2024, PayPal is rolling out more contactless payment options that work in stores, positioning itself as a competitor to mobile wallets like Apple Pay.

Targeting Small and Medium Businesses (SMBs):

PayPal has always been popular with large companies, but under Chriss’s leadership, PayPal is focusing more on small and medium businesses (SMBs). SMBs often struggle to find affordable, easy-to-use payment solutions, and PayPal sees this as an opportunity.

The company has introduced new features designed specifically for small businesses, such as financing options and tools to help businesses grow and manage payments more effectively.

By offering solutions tailored to SMBs, PayPal can tap into a large, underserved market while strengthening its customer base for long-term growth.

Key Financials – How PayPal is Doing in 2024!

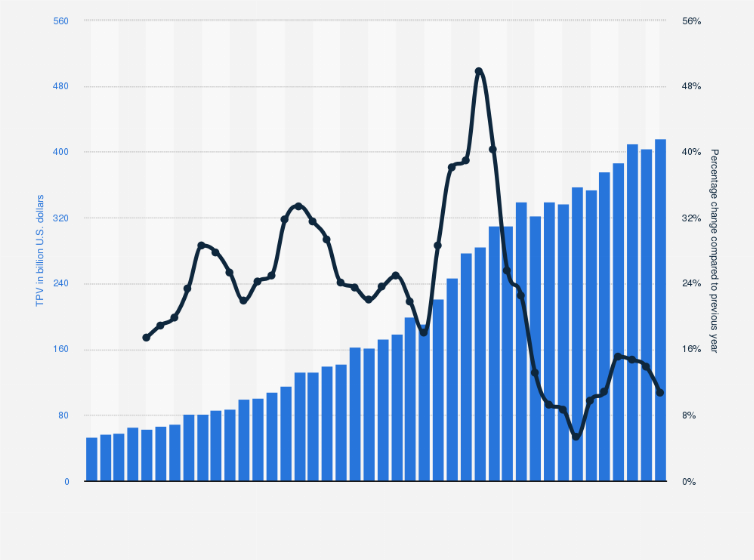

Growth in Payment Volume:

One of the key indicators of PayPal’s health is its total payment volume (TPV), which measures the total value of payments processed by PayPal. In the first quarter of 2024, PayPal saw 14% growth in TPV, reaching $403.9 billion.

This growth shows that more people and businesses are using PayPal for payments, which is a positive sign for the company’s future.

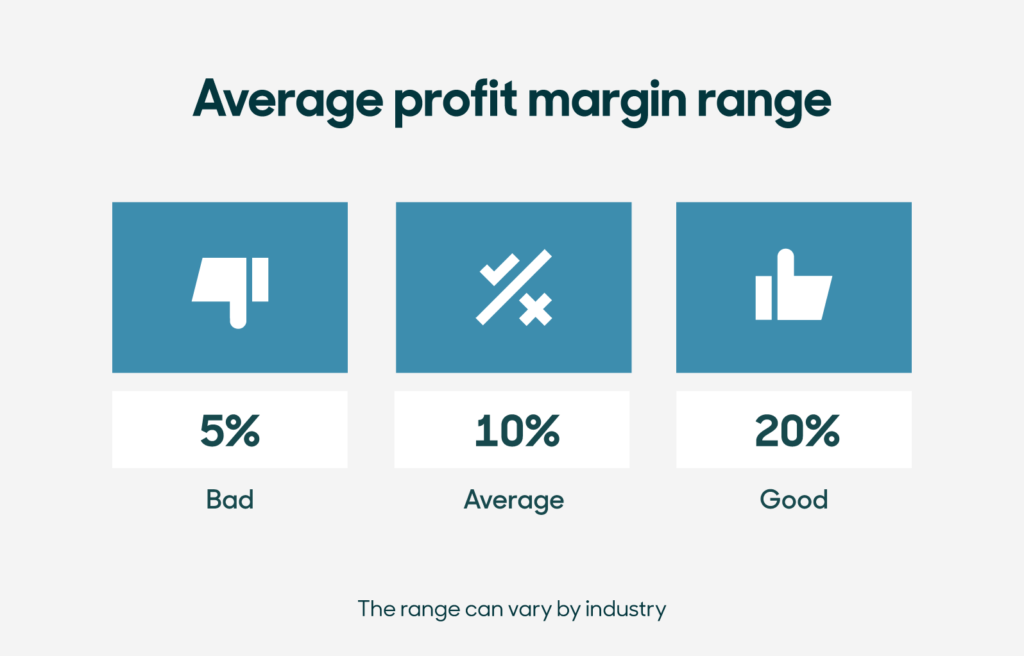

Improving Profit Margins:

In addition to growing its payment volume, PayPal’s adjusted operating margins have improved. In the first quarter of 2024, PayPal saw a 0.84% improvement in its operating margins, reaching 18.2%. This is a sign that the company’s focus on cost efficiency and profitability is working, and that PayPal is moving towards a more sustainable business model.

Positive Outlook for 2024:

PayPal’s strong performance has led the company to raise its forecast for the year. The company now expects its adjusted profit to grow by mid-to-high single digits in 2024. This is a positive sign that PayPal is on the right path, and investors are increasingly confident in its ability to deliver growth and improve profitability.

How does PayPal plan to compete with Apple Pay and Google Pay in 2024?

In 2024, PayPal is intensifying its efforts to compete with Apple Pay and Google Pay, two of the dominant players in the digital payments space. To stay competitive, PayPal is focusing on several key strategies aimed at enhancing its user experience, improving transaction efficiency, and expanding its services to better serve both consumers and businesses.

Enhanced Branded Checkout Services:

PayPal will improve its branded checkout to make payments faster and more seamless, competing with Apple Pay and Google Pay in both online and in-store transactions.

Expanding Venmo for Business Transactions:

Venmo will be expanded to support business payments, allowing PayPal to tap into the merchant market and compete with Apple Pay and Google Pay for business use.

Offline Payment Capabilities:

PayPal is enhancing its Fastlane feature to enable easier, one-click payments at physical stores, offering a strong alternative to Apple Pay’s and Google Pay’s contactless solutions.

New Partnerships and Integrations:

PayPal will form new partnerships with merchants and tech companies to expand its payment solutions and reach more customers.

Focus on Security and Innovation:

With a strong focus on security and innovation, PayPal aims to provide a safer, more reliable payment experience through advanced features like biometric authentication and fraud prevention.

READ MORE: Singletimeline.shop – Change the Way You Shop Online Forever!

FAQ’s:

How is PayPal improving its profit margins?

PayPal is improving its margins by streamlining its operations, cutting unnecessary costs, and offering more value to merchants. This includes better payment solutions that help businesses increase their sales and reduce cart abandonment.

What is PayPal’s strategy to grow in 2024?

In 2024, PayPal is focusing on expanding its branded checkout services, growing its presence in offline payments, and targeting small and medium businesses with new payment solutions and tools.

What is the role of Venmo in PayPal’s strategy?

PayPal is expanding Venmo’s use beyond person-to-person payments by making it available for business transactions. This helps increase transaction volume and boosts PayPal’s margins.

What is PayPal’s outlook for 2024?

PayPal expects mid-to-high single-digit growth in adjusted profit for 2024, driven by its focus on improving margins and expanding into new growth areas.

Will PayPal’s 2024 growth plans benefit small businesses?

Yes, PayPal’s 2024 growth plans focus heavily on supporting small businesses through cost-effective payment solutions, better merchant tools, and easier access to payment systems, helping them grow and stay competitive.

Conclusion:

In 2024, PayPal is stepping up its competition with Apple Pay and Google Pay by enhancing checkout services, expanding Venmo for business, and improving offline payment options. With a focus on security, innovation, and strategic partnerships, PayPal is strengthening its position in the digital payments market.

READ MORE: