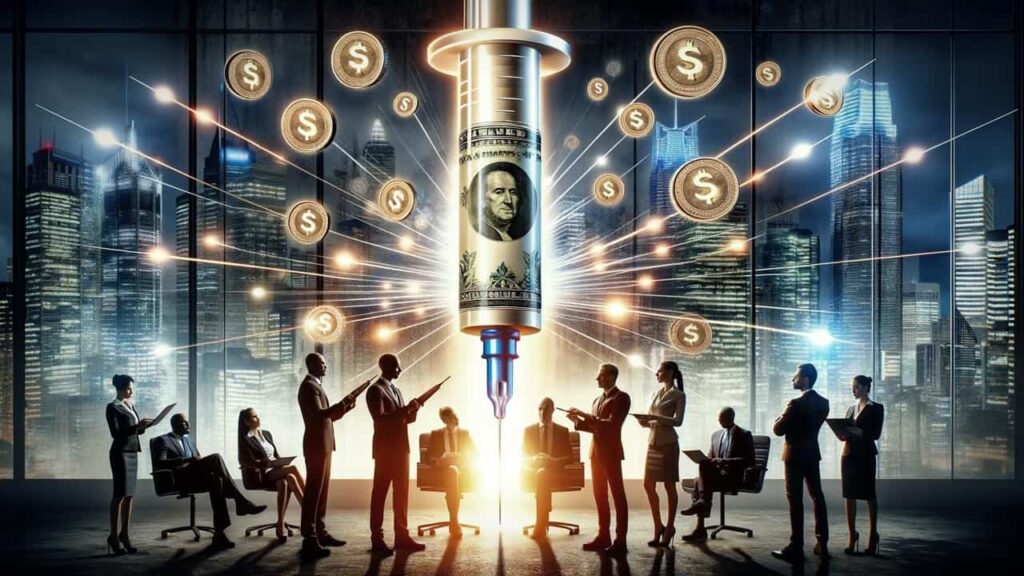

Capital Injection – Enhancing Investment Strategies!

Capital injection, or ‘monievest,’ has been pivotal in my personal investment journey, enabling me to expand my portfolio and pursue new opportunities. Through strategic allocation of additional funds, I’ve experienced accelerated growth and enhanced financial stability.

Capital injection, also known as ‘onievest,’ involves infusing additional funds into investments to spur growth and expand opportunities. This strategy enhances financial portfolios and fosters resilience against market fluctuations, empowering investors to achieve their financial objectives more effectively.

Join us as we disscus about capital injection.

When to Think About Capital Injection?

Consider capital injection when you’re looking to strengthen your investment portfolio, seize new opportunities, or overcome financial obstacles.

It’s a strategic move to enhance growth and resilience in your investments, especially during periods of market volatility or when seeking to expand your business ventures.

Why is Capital Injection Important?

Capital injection is crucial because it provides financial resources needed to fuel growth, innovation, and sustainability in businesses. It allows companies to invest in new projects, expand operations, hire talent, and weather economic downturns.

Essentially, capital injection strengthens financial foundations, enabling businesses to thrive and adapt in dynamic market environments.

Read: Geekzilla Autos – Opportunity To Elevate Your Driving

When is a Capital Injection Needed?

A capital injection is needed in several important situations to help a business grow, stay stable, and survive tough times.

When starting a new business, extra money is crucial for setting up operations, buying necessary equipment, and covering initial costs.

For businesses that want to grow, additional funds are needed to expand, create new products, enter new markets, or increase production.

Financial problems, like those caused by economic downturns or unexpected expenses, can also require a capital injection to keep the company afloat and avoid bankruptcy.

Capital injections are also essential when there are unforeseen costs, such as emergency repairs or legal issues, that the business needs to cover.

How is a Capital Injection Done?

A capital injection is done in a few simple ways, each helping the business get the money it needs. One way is through equity investment, where people or companies buy shares of the business, giving it money in exchange for partial ownership.

Another way is by taking out loans from banks or other lenders, which means the business gets money now but has to pay it back with interest later.

Government grants are also an option, where the business gets money, often for specific projects like creating jobs or new products, and usually doesn’t have to pay it back.

Private funding from venture capitalists or private investors is another way, where these investors provide money in return for a share of the business or a promise of future profits.

Businesses can also issue bonds, which are like loans from investors that the business will repay with interest at a later date.

Read: Acúmen – Unlock Your Potential With Acúmen!

What is Capital Injection (Monievest)?

Capital injection, or monievest, involves the infusion of funds into a business or investment venture. This injection of capital can take various forms, such as equity financing, debt financing, or even a combination of both.

The purpose of capital injection is to strengthen the financial position of the entity and support its long-term objectives.

How Capital Injection Works?

Capital injection works by providing the business or investment venture with additional funds that can be used for various purposes.

These purposes may include expanding operations, investing in new projects, paying off existing debts, or increasing working capital.

The injection of capital can be structured in different ways, depending on the specific needs and circumstances of the entity.

What are the Benefits of Capital Injection?

Financial Stability:

Capital injection can help improve the financial stability of a business or investment venture, providing it with the resources needed to weather economic downturns or unexpected challenges.

Enhanced Competitive Advantage:

With access to additional capital, businesses can invest in research and development, innovation, and marketing efforts, thereby enhancing their competitive advantage in the marketplace

Increased Debt Burden:

Dilution of Ownership: Equity financing, which involves selling shares of the company to investors, can result in the dilution of ownership for existing shareholders.

Increased Debt Burden: Debt financing, while providing immediate liquidity, also increases the debt burden of the business, which may impact its financial flexibility and ability to repay loans.

Risk of Misallocation: Poorly managed capital injection can lead to the misallocation of funds, resulting in wasteful spending or failed investment initiatives.

Read: Alevemente – Unveiling The Wellness Revolution!

Conclusion:

Capital injection, or monievest, plays a crucial role in the financial health and growth of businesses and investment ventures. While it offers numerous benefits, including enhanced financial stability and support for growth initiatives.

FAQs:

1. What are the main sources of capital injection?

Capital injection can come from various sources, including investors, shareholders, banks, financial institutions, or even the business owners themselves.

2. How is capital injection different from other forms of financing?

Capital injection typically involves the infusion of funds into a business or investment venture, whereas other forms of financing, such as loans or lines of credit, involve borrowing funds that must be repaid with interest.

3. What factors should businesses consider before seeking a capital injection?

Businesses should consider factors such as their current financial position, long-term growth objectives, risk tolerance, and the potential impact on existing shareholders before seeking a capital injection.

4. Can capital injection be reversed or undone?

Once capital injection is made, it becomes part of the entity’s capital structure and cannot typically be reversed or undone without significant legal or financial implications.

5. Are there any tax implications associated with capital injection?

The tax implications of capital injection can vary depending on the specific circumstances and applicable tax laws. It is advisable for businesses to consult with tax professionals or financial advisors to understand the potential tax consequences.

Read more: